How could RSI help you on defining stock price movement?

What is RSI

The Relative Strength Index (RSI), is a momentum oscillator that measures the speed and change of price movements. The RSI oscillates between zero and 100. Traditionally the RSI is considered overbought when above 70 and oversold when below 30. Signals can be generated by looking for divergences and failure swings. RSI can also be used to identify the general trend.

RSI Formula

RSI is a fairly simple formula, it is a very common indicator

RSI = 100 – [100 / ( 1 + (Average of Upward Price Change / Average of Downward Price Change ) ) ]

By default, the system draws three lines on the secondary map, which are 6-day RSI1, 12-day RSI2, and 24-day RSI3.

In a normal stock market, only when the strength of both long and short sides is balanced, the stock price can be stabilized.

The RSI reflects four factors in stock price movements:

the number of days stock price moves upwards

the number of days stock price moves downward

the magnitude of the stock price move upward

the extent of the stock price move downward

Application Guideline RSI

- RSI is considered overbought when above 70 and oversold when below 30.

- In an uptrend or bull market, the RSI tends to remain in the 40 to 90 range with the 40-50 zone acting as support.

- During a downtrend or bear market the RSI tends to stay between the 10 to 60 range with the 50-60 zone acting as resistance.

These ranges will vary depending on the RSI settings and the strength of the security’s or market’s underlying trend.

If underlying prices make a new high or low that isn't confirmed by the RSI, this divergence can signal a price reversal.

If the RSI makes a lower high and then follows with a downside move below a previous low, a Top Swing Failure has occurred.

If the RSI makes a higher low and then follows with an upside move above a previous high, a Bottom Swing Failure has occurred.

During strong trends, the RSI may remain in overbought or oversold for extended periods.

How to Apply RSI - HP Case Study

On April 7th, news released that Warren Buffett bought HP stocks, this pushed HP stock price up.

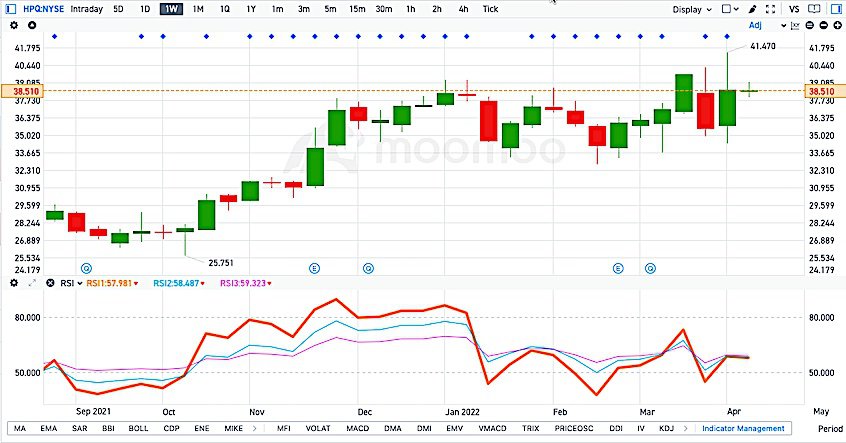

Below is HP stock chart and RSI trend chart extracted from moomoo App

By reading the above chart, RSI falls in normal range, all three RSI line, RSI 6 days, 12 days, 24 days, are in the same patten, which indicates that HP stock price, although goes up after Buffett's purchsement news announcement, still have room to move up in the short run.