Why more and more investors choose ETF rather mutual funds?

ETFs are an important part of investment portfolios, and it is interesting that Morgan Stanley plans to launch an exchange-traded fund platform this year. It will be considered a first-class ETF platform that will enable Morgan Stanley to pair it with its world class investment capabilities. The ETF platform will add to the diverse set of investment vehicles that Morgan Stanley’s clients demand.

ETFs are ideal instruments for beginner traders as well as the experienced trader. The important fact to keep in mind with ETFs is that they can be traded intra-day rather than only being available for purchase at the end of each trading day based on the net asset value, which is how mutual funds are traded.

To give a bit of background, mutual funds have been around for almost a century, while ETFs launched in 1993. In years past, mutual fund managers made decisions about how to allocate assets in the fund, while ETFs were passively managed and tracked market indices. However, this distinction is becoming blurred by the fact that passive index funds are making up a now significant portion of mutual fund assets under management. Alternatively, for ETFs there is a growing amount of actively managed ETFs available.

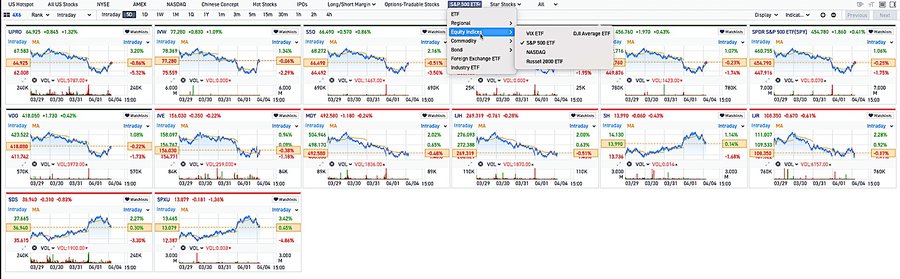

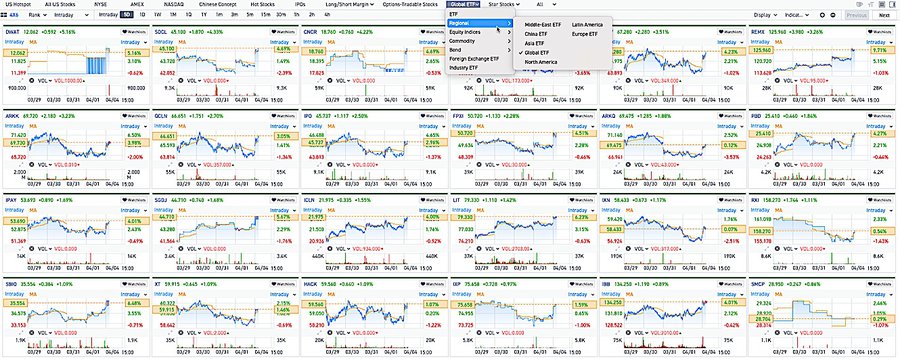

Below are a few ETFs examples related to Index EFT, Equity ETFs, Commodity ETFs, Global ETFs, which are extracted from moomoo app

The above chart illustrates Equity ETF, which is composed of SP 500 ETF, NASDAQ ETF, Russel 2000 ETF, meaning these ETFs track the index of SP500 and make adjustment, if passive ETFs, the adjustment is done twice a year, if active ETFs, the adjustment is more frequently.

The above chart illustrates Global ETF, which is composed of Asian ETFs, Global ETFs, Northamerica ETFs, ARKK is one of Global ETFs, managed by Cathie Wood, Cathie Wood Twittered often about her investment strategies, ARKK is a active ETF, its components are adjusted often.

The above chart illustrates Commodity ETFs, it is composed of Crude Oil ETFs, Raw Materials ETFs etc., as we can see from above Crude Oild EFTs, the Energy ETFs hit multiyear highs amid Russia-Ukraine conflict.

As an investor, if your investment goal is to avoid single stock risk, minimum tax impact, investing in ETFs are very good choice.